In this article, we will tell you about the entire process of taking a personal loan on Phonepe. This process will be very simple and clear, which will take you to your destination. Hundreds of people have easily got phonepe loan by reading our article.

Before knowing about PhonePe instant loan, let us briefly know the PhonePe platform. PhonePe is a comprehensive digital payment platform, that allows online money transfers, payments, banking statements and consuming various financial services easily.

What is a PhonePe Personal Loan?

This is a type of loan. Like banking and non-banking institutions, PhonePe has started the facility of giving personal loans by creating a loan platform. For this, partnership with Muthoot Fincorp, Tata Capital, Hero Fincorp, L&T Finance, DMI Housing Finance, Home First Finance, Volt Money, Rupi and Graderight. Is of.

👉 According to the information received by November 2023, the number of registered users in PhonePe was 500 million.

👉 According to the data received, PhonePe is distributing merchant loans worth Rs 300 crore every month.

Features of PhonePe Personal Loan

1. Quick Approval Process: Being a completely digital process, get a loan easily without visiting any bank and without any paper process.

2. Completely transparent process: The applicant and PhonePe enter into a contract. All the procedures and conditions of this contract are placed before the applicant so that he can get complex information about the loan.

3. Digital Payment: The loan received comes directly into the account. There is no possibility of risk to your financial data.

4. 24/7 Access: The biggest feature of the PhonePe platform is its 24/7 accessibility. So that you can get a solution to the problem related to the platform anytime.

5. Flexible Repayment System: You can repay monthly without any extra charges.

6. Ideal for emergencies: In case of any emergency, you can get the loan anytime and anywhere without any paperwork.

Eligibility for PhonePe Loan

1. He should be an Indian citizen.

2. His age should be between 21 to 60 years.

3. The minimum credit score for a personal loan should be 700 or above.

4. He should not have any existing loan outstanding.

5. His/her KYC information is complete.

6. The minimum monthly income of the family should be Rs 25000.

Documents required for application

1. PAN Card

2. Address Proof

3. Income Proof (Bank Statement)

4. Employment Proof (Salary Slip/Office ID)

Watch the process video

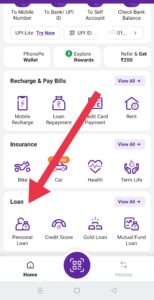

how to apply

1. You download the PhonePe app from the Play Store and register.

2. Open the app and scroll down to the loan section on the main screen.

3. Check your eligibility and choose the right lender.

3. Check your eligibility and choose the right lender.

4. Select the loan option as per your requirement (Personal Loan, Business Loan and Flexi Personal Loan).

5. Sign up with your phone number.

6. Fill out the application with the required documents.

7. Upload the required original documents.

8. Once the verification process is complete, you will have to e-sign.

9. After this the loan amount will be deposited in your account.

PhonePe Personal Loan Loan Amount and Interest Rate

PhonePe and its partner financial institutions together complete the loan disbursement process. In this, after application, the loan amount will be distributed to your linked bank account in 2 to 3 days.

👉 Loan ranging from Rs 10000 to Rs 500000 is provided through PhonePe. This loan is given at an annual interest rate ranging from 17-29.95%.

👉 This loan and interest rates also depend on your credit score and your annual income.

Do you want to know about SIP and FD

Difference between phonePe loan and google pay loan

Google pay loan | PhonePe loan | |

Loan amount | 10,000 -12,00,000 | 10,000 - 5,00,000 |

Monthly EMI | 2000 | 2000 |

Loan period | 6 month - 5.25 year | 3 month - 3 year |

Annual Intrest rate | 13% | 17% - 29.95% |

Credit score | 700+ | 700+ |

PhonePe Loan EMI Payment

1. Scroll down a bit on the main screen of PhonePe and click on Loan Repayment

2. Select the lender from whom we have taken the loan.

3. Enter your agreement number and proceed.

4. Once the process is complete, you will be able to pay through EMI.

Should you take a personal loan on phonePe?

Yes, PhonePe has launched its digital payments platform as a lending financial institution. With a simple loan process and the trust of users, PhonePe has built a strong network due to which you can choose it for personal loans.

What is the penalty for late payment of phonePe loan installment?

The penalty for late payment of phonePe loan installment is usually 2%-3% of the EMI. After this, if the loan user does not deposit the loan installment within 60 days, then PhonePe’s associated partner financial institution engages the recovery agent.

FAQ

1. What is the maximum loan amount available?

PhonePe gives different types of loans according to the purpose. The maximum amount for a personal loan is Rs 5,00,000 and the maximum amount for a business loan is Rs 4,00,000 lakh.

2. How much time does it take to receive the phonePe personal loan amount?

After completion of the application process, the loan amount will be credited to your account within 2-3 days.

3. What is the customer care number on the phone?

To make phonepe services easier and in case of any risk, you can get the solution by calling phonePe customer care number 80 6872 7374.

conclusion

In this article, we have clarified every aspect related to PhonePe. PhonePe Loan is gradually moving forward in the loan sector like banking institutions. This is a reliable loan provider. You all must also take advantage of it. Comment to get a solution to the problem faced in taking any kind of loan.